The market size of aluminum electrolytic capacitors is more than 5 billion US dollars, and the main application fields are home appliances, industry and lighting. The aluminum electrolytic capacitor is made of the aluminum cylinder as the negative electrode and is filled with liquid or solid electrolyte. Because of its large anode area, it can reach a high capacitance value, and it is a high-pressure and high-capacity product in the whole capacitor industry. The aluminum electrode material needs to be corroded and formed into two processes. Corrosion foil refers to corrosion of the surface of the aluminum foil by acid etching to form a hole to expand the specific surface area; forming a foil means that the etched aluminum foil is oxidized to form an oxide film on the surface. The global market is relatively stable, with consumer electronics applications accounting for up to 35%, and domestic consumption is larger than in other regions, with the computer and peripheral applications accounting for 22%, and industrial, power and lighting applications accounting for 18%. Japanese companies still dominate the market. In 2015, NCC, Nichicon, Rubycon, and Panasonic accounted for 56% of the global market. The domestic companies Aihua Group and Jianghai share a relatively small share, but are expanding year by year.

Aluminum electrolytic capacitors have been out of stock since 2016. The gap between supply and demand in 2016 was about 5%, and the gap continued to widen in 2017. The original gap is mainly based on high-voltage products supplied by Japanese merchants, and has recently spread to horn-type aluminum electrolytic capacitors with increasing use of electric vehicles, new energy sources and inverters. The price of aluminum electrolytic capacitors of NCC, Rubycon and other brands has increased, and there is no obvious capacity expansion at the supply end. The price increase will continue until the end of the year, but it will not last long after the year. In the third quarter of 2017, the Japanese factory Rubycon increased its product line by 10%. On January 10, 2018, Nikko announced that it will increase the price of the plug-in and screw-type models by 5%. On January 11th, Taiwan’s Zhibao will follow up, and the low-voltage products will increase by 8%~10%. Increased by 10% to 12%, high-pressure products increased by 6% to 8%, and other manufacturers have also announced price increases.

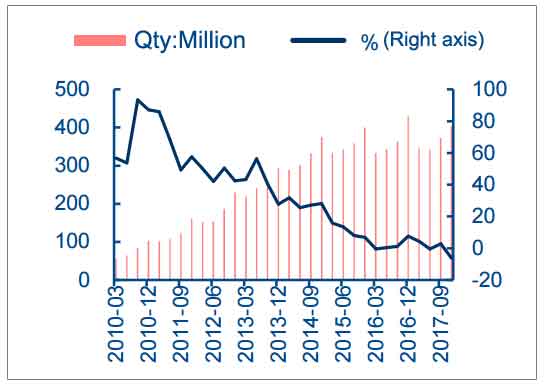

Smartphones are seasonally volatile and demand for home appliances is rising steadily. Global smartphones show significant seasonal fluctuations, and mobile phone shipments in the fourth quarter of each year will see a large increase, and the demand for aluminum electrolytic capacitors by corresponding mobile phone manufacturers will also have seasonal fluctuations. The price increase of this aluminum electrolytic capacitor began at the end of 2017, which coincides with the seasonal demand for fluctuations. As a high-profit downstream application of aluminum electrolytic capacitors, inverter household appliances also showed strong demand in 2017, such as air conditioner growth rate of 44% and refrigerator growth rate of 6%. Aluminum electrolytic capacitors for household appliances inverters, inverters, and general-purpose power supplies account for 5%-6% of the total cost of the machine, and the corresponding cost for air-conditioning is about 30 yuan. According to the domestic annual shipment of 140 million units, it will bring about 4 billion yuan. Space, accounting for nearly 30% of the market for aluminum electrolysis.

Global smartphone shipments (unit: million units)

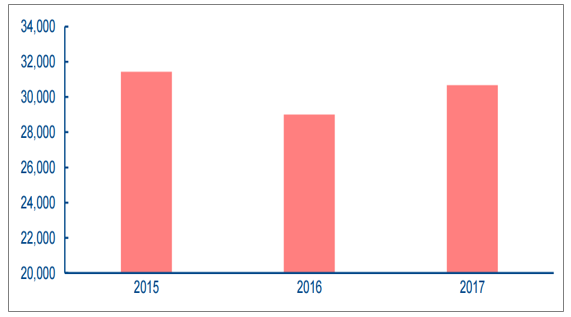

Computers and surrounding industries have entered the era of stocks, and demand has remained stable. In the past three years, the computer industry has remained in a state of sluggishness. In 2016, China’s microcomputer production was -7.7%, and +5.8% in 2017, and it has not yet returned to the 2015 level. The reason is that the market penetration rate of the computer industry has reached a high level, and the product replacement is slower, so the growth is not obvious.

China’s microcomputer equipment production status (unit: milion)

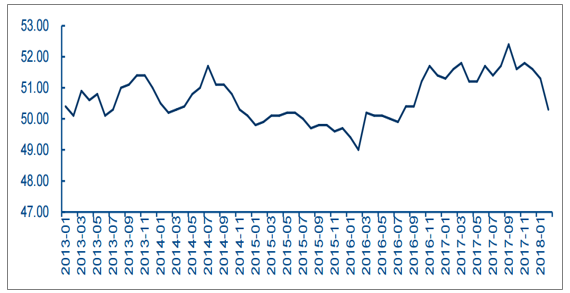

The manufacturing industry is picking up and industrial power demand is recovering. Since August 2016, the PMI index has gradually recovered from the low level. In October 2017, PMI 51.6, the rebound of the index verified the trend of manufacturing recovery. In September 2017, the added value of the general equipment industry increased by 11.1%, and the national PPI rose by 6.9% year-on-year and 1.0% quarter-on-quarter. It rebounded after a three-month month-on-month decline, and the manufacturing industry continued to recover. The recovery of the manufacturing industry will drive the demand for industrial power, which will increase the demand for aluminum electrolytic capacitors.

Domestic PMI Index

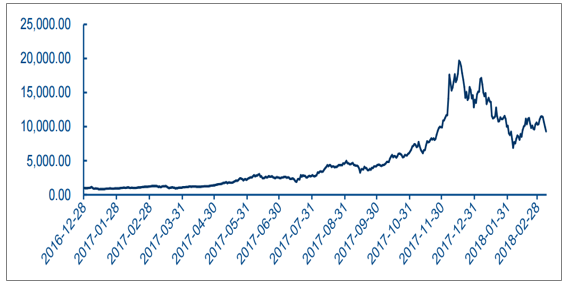

The demand for mining machines has soared, and the demand for aluminum electrolytic capacitors has exceeded 400 million yuan in the short term. In the second half of 2017, Bitcoin rose from less than $2,500 to nearly $20,000, an increase of nearly 700%. Due to the exponential growth of Bitcoin, there is a large demand for bitcoin mining machines and aluminum electrolytic capacitors. There are about 160 chips in each bitcoin mining machine. Each chip needs a common pin-type aluminum electrolytic capacitor to achieve first-order filtering, and the mining machine has a large demand for solid aluminum electrolytic capacitors. According to industry sources, in September 2017, domestic miners had a monthly demand for ordinary solder-type aluminum electrolytic capacitors of 3 million, and solid aluminum electrolytic capacitors had a monthly demand of 30 million, and the domestic market exceeded 60 million yuan. Since Bitco’s subsidiaries account for approximately 14.3% of the global bitcoin computing power, it is conservatively estimated that the demand for aluminum electrolytic capacitors in the short-term global mining machine market will exceed 400 million yuan.

Bitcoin against the dollar

The smartphone market is huge, and the matching charger market has brought about an additional $0.7 billion in aluminum electrolysis demand. The global smartphone market is highly developed, with shipments reaching 1.29 billion units in 2015, with at least one mobile phone charger per mobile phone. Most of the brand mobile phone chargers have 3 aluminum electrolytic capacitors, and there are 4 Apple chargers. According to the estimated shipments of smartphones in 2015, it will bring a new market space of 305 million electrolytic capacitors, with a market share of about 0.7 billion US dollars.

Fast charger penetration has climbed to 20% in 16 years. Fast charging means increasing the charging power, which can be divided into two kinds of fast charging schemes: high voltage and low voltage; high voltage fast charging means increasing charging voltage; low voltage fast charging increases charging current. In order to achieve fast charging, adapters, main chipset, data lines, power management, etc. need to be upgraded accordingly. The function of the capacitor in the fast charger is after voltage transformation and output filtering. The domestic mainstream camps Huawei, Xiaomi and South Korea’s Samsung have launched the corresponding products of fast charging technology, and the iPhone 8 is also equipped with fast charging function. The fast charge penetration rate increased from 5% at the beginning of 2015 to 20%-30% in 2016.

In 17 years, the upstream cost of aluminum electrolysis has increased by 7%-10%, which has stabilized the price increase. Since the beginning of 2016, the price of aluminum has started to rise, with an average annual rate of +19.3%. In 2017, the electricity price dropped slightly, with an average annual rate of -11%. Based on the above factors, the price of electrode foils increased by 5%-10% in 2017, resulting in an increase in the cost of aluminum electrolytic capacitors. Domestic labor costs have been on the rise, from +15.39% in 2010. Therefore, the upstream cost of aluminum electrolytic capacitors is generally increased by about 7-10%.

Aluminum price (unit: USD/ton)