According to EE Times China, in the past two years, MLCC prices have led the gains, and chip resistors have followed the rapid rise in prices. However, the aluminum electrolytic capacitor market has been seriously out of stock but the price has risen less? Even the market speculators or spot dealers are not willing to fry electrolytic capacitors. What is the reason?

Due to the surge in demand for capacitive components for smart phones, electric vehicles, drones, the Internet of Things and smart home appliances, MLCC prices have risen in the past two years, and chip resistors have followed the rapid rise in prices. However, the aluminum electrolytic capacitor market has been seriously out of stock but the price has risen less?

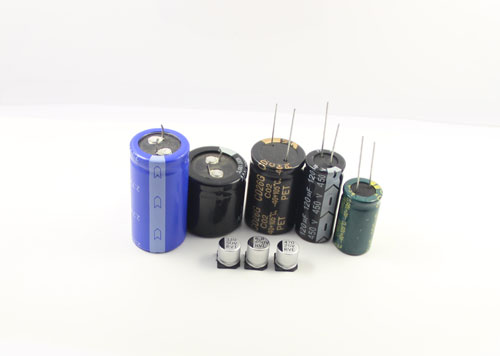

The production of aluminum electrolytic capacitors is not as concentrated as MLCC, chip resistors and chip inductors. It is reported that Japan, Taiwan, South Korea and China are the major producers and regions of aluminum electrolytic capacitors in the world. Four of the world’s top five aluminum electrolytic capacitor manufacturers are Japanese companies, including Chemi-con, Nichicon, Rubycon and Panasonic. (Panasonic). Also in Japan are TDK-EPCOS. South Korea has Samyoung, Samwa, etc.; China’s Aihua Group and Nantong Jianghai are leading aluminum electrolytic capacitors, while Taiwan has Lilong Electronics, Zhibao, and Hong Kong-owned Wanyu Sanxin.

The major suppliers of global MLCC include Murata, TDK, Taiyo Yuden, Kyocera, Panasonic, Guoju, Huaxinke and Fenghua Hi-Tech. The top three global chip inductors are: TDK-EPC, Murata and Taiyo. The main reason for the rapid increase in the price of MLCC and chip inductors in the past two years is that their core manufacturing materials are in the hands of the major Japanese suppliers. They take the lead in announcing the price increase and the peers are willing to follow up.

Why are aluminum electrolytic capacitors out of stock? In fact, since 2017, aluminum electrolytic capacitors have been out of stock in the whole industry, but the price has not risen as fast as MLCC or chip inductors. Even the market speculators or spot dealers are not willing to fry electrolytic capacitors. The reason is that even if the price of such enterprises is out of stock, there is not much room for price difference of roasted seeds and nuts. Why is this?

According to statistics from the Taiwan Industrial Technology Research Institute, the global application of aluminum electrolytic capacitors is 45% for consumer electronics, 23% for industry, 13% for information, 7% for communications, 5% for automobiles, and 7% for other industries. Consumer aluminum electrolytic capacitors are mainly used in consumer markets such as energy-saving lighting, televisions, monitors, computers and air conditioners; industrial aluminum electrolytic capacitors are mainly used in industrial and communication power supplies, professional inverters, CNC and servo systems, wind power generation and automobiles. And other industrial fields.

From the application of aluminum electrolytic capacitors, it can be seen that aluminum electrolytic capacitors do not appear on portable fast-dissipating products due to the limitation of volume, but more appear in the fields of industry, automobile, home appliances, lighting and the like. The demand for these application areas is basically no such large-scale application as smart phones. Even in the fast-growing application demand such as charging piles that have appeared in the past two years, the capacity expansion of aluminum electrolytic capacitors can basically follow. on.